Since 01 January 2021,CO2 pricing, also known as the “CO2 price” or “CO2tax“, has been in force. In the eyes of many entrepreneurs and consumers, this is an additional burden, as the new levy will cause energy prices to skyrocket, thereby increasing heating costs, among other things. Learn more about the newCO2 tax and its consequences in this article.

NowCO2 also has a price in Germany

To protect our livelihoods, the global community agreed at the 2015 UN Climate Change Conference in the Paris Agreement to limit global warming to well below 2°C, and preferably to 1.5°C. To achieve this, we must be greenhouse gas neutral from 2050. Since then, more and more measures have been developed to achieve this goal – both internationally and at the European and national levels. The European Union aims to reduce greenhouse gas emissions by at least 55 percent by 2030 (the year of comparison is 1990). With the so-called EU ETS (European Union Emissions Trading System), there is emissions trading for almost the entire energy industry. The goal: to reduce climate-damaging gases by issuing a limited number of emission rights as an incentive to do so and trading them freely on the market. Outside of European emissions trading, however, such an incentive has been lacking. In the National Climate Protection Program 2030, the German government therefore adopted price incentives in addition to subsidy programs and regulatory measures.

The transport and heating sectors are particularly important, as they account for around one-third of climate-damaging emissions. CO2 emissions in the heating segment alone are to be reduced by 80% by 2050. The way to this was paved when the Fuel Emissions Trading Act (SESTA) came into force at the end of 2019. Based on this, greenhouse gas emissions now also have a price in Germany. Since 2021, Germany has relied on its own additional instrument for reducingCO2 emissions, known as theCO2 tax, in the form of national emissions trading (nEHS). The federal government is thus setting clear goals:

- Achieving the minimum targets of the EU climate protection regulation

- Meet national climate protection targets, especially greenhouse gas neutrality by 2050.

- Improve energy efficiency

How does theCO2 tax work?

The newCO2 tax, which has been in force since January 01, 2021, relates to the transport and building heat sectors. It stipulates that the combustion of fossil fuels such as heating oil, liquefied petroleum gas, natural gas, coal, gasoline and diesel will be “taxed” with immediate effect by a fixed, gradually increasing price. This is intended to create incentives to use less energy and switch to more environmentally friendly alternatives.

But how does theCO2 tax work now? Companies that place these fuels on the market must acquire so-called “emission rights” with certificates. These allowances are based on a predetermined threshold quantity of emissions; their number is reduced from year to year. Who acquires these certificates differs depending on the fuel. In the case of natural gas, for example, these are the municipal utilities as those who supply the end consumers. Certificates for petroleum products have to be purchased mainly by producers (e.g. refineries) and traders. The cost of these emission allowances will be passed on to end users, i.e. residential customers and businesses, with the result that prices for heating fuels and motor fuels will rise from 2021 onwards.

What additional costs will you incur with theCO2 tax?

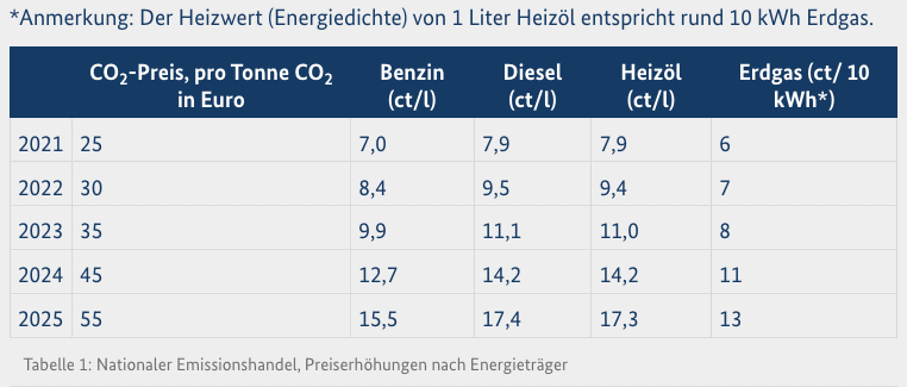

To enable business and consumers to gradually adjust to the new system, fixed prices will initially apply to theCO2 tax. They will start at 25 euros per metric ton ofCO2 in 2021 and rise gradually until 2025. From 2026, the scheme envisages that the cost of theCO2 tax will initially develop in a price corridor between €55 (minimum) and €65 (maximum) per metric ton ofCO2, depending on the market, and will move to a free trading phase from 2027. In 2025, a decision will be made at the political level on further pricing. Thus, fossil fuel costs will increase gradually, most moderately for natural gas at 6 cents per 10 kWh in the first year.

What does theCO2 tax mean in concrete terms and what should you do?

First and foremost, theCO2 tax means two things:

- Heating and mobility are becoming more expensive.

- Energy sources, energy use and technologies must be reassessed and made much more efficient to absorb rising costs.

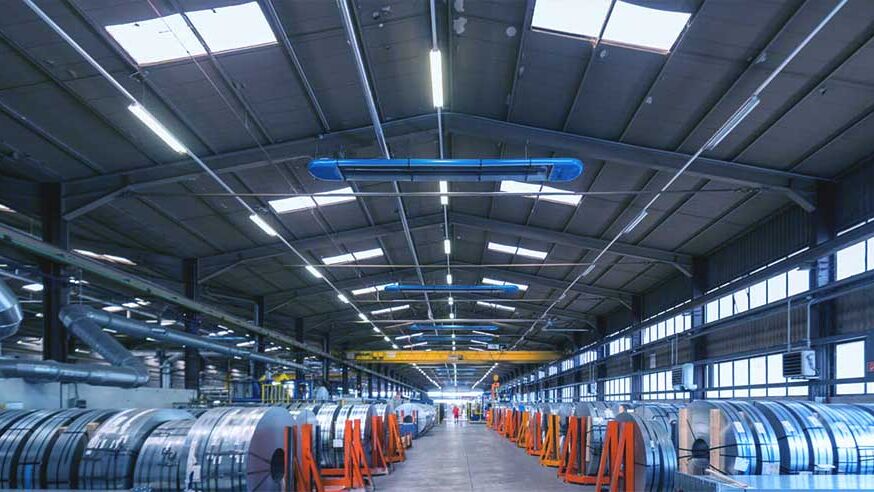

In line with the motto “The cleanest and cheapest energy is that which is not consumed in the first place,” the German Federal Ministry for Economic Affairs and Energy is focusing on resource conservation with its Deutschland macht’s effizient campaign, among other things. The principle of “efficiency before substitution” applies here. For example, if you are already currently using modern, decentralized efficiency technologies for heating that use fossil fuels but are very energy efficient, there is less need for action. By the way, from a height of more than four meters, you are exempt from the Renewable Energy Obligation of the GEG when heating with decentralized technologies in the new construction of hall buildings.

Energy efficiency is not only a necessity from an ecological point of view, but is also increasingly important from an economic point of view. Therefore, of course, in the long term you should not hesitate to modernize your heating system or switch to alternative energy sources. This can also be natural gas in the future – because: The upcoming feed-in of hydrogen (power-to-gas) and the possibility of producing natural gas synthetically will make this energy source increasingly greener and more renewable. For more information, read our article on future technologies for heating modernization!

What opportunities does business have to save costs despite theCO2 tax?

The good thing about the SESTA and the newCO2 tax is that policymakers are using them to create real incentives to make companies and consumers more energy efficient, to use climate-friendly energy sources and to develop innovative products. Moreover, with the price regulation set until 2026, there is planning certainty and a sufficiently large window of opportunity to react. So as a company or consumer, you decide for yourself: Does it make more sense for you to pay theCO2 tax or to counteract the cost increase with suitable measures? Our tip: try to achieve your goals with as little energy as possible and examine the use of regenerative energies in the long term. This way, both sides benefit: the climate and your company. Below we give you examples of how you can increase energy efficiency:

- Increased thermal insulation

- The use of energy-efficient technologies

- The use of heat recovery and residual heat

- The use of intelligent control technology

- Switching to energy sources with lower emission values (e.g., natural gas instead of fuel oil).

- The integration of solar thermal and other renewable energies

How can rising costs be avoided?

- § Section 11 of the SESTA ensures financial compensation to companies by way of a hardship clause if they are unreasonably affected by rising prices. Prerequisites are:

- Fuel costs account for more than 20% of the total cost of operation.

- Additional costs incurred by the company as a result of the introduction of the SESTA would exceed 20% of gross value added.

In addition, double burdens resulting from the use of fuels in a plant subject to EU emissions trading are to be avoided as far as possible.

It is also planned to provide relief to those companies that would experience disadvantages on the international market as a result of theCO2 tax. For many foreign competitors,CO2 pricing and the resulting increase in fuel costs are no longer an issue. The solution comes in the form of the so-called “Carbon Leakage Regulation”: Those who suffer disadvantages on the international market as a result of theCO2 tax will receive financial compensation. This is how Germany wants to prevent companies from relocating. However, affected companies must demonstrate that they have an energy management system in place and are already working to reduce theirCO2 emissions. They must then use the benefits to further reduce theirCO2 emissions.

Will my climate protection measures be funded?

At the national level, the federal government supports investment in climate protection through a number of comprehensive, and in some cases updated, funding programs and grants. These include, for example, the Federal Support for Efficient Buildings (BEG) or the Federal Support for Energy Efficiency in Business. You can apply for these programs either as a grant through BAFA or as a loan subsidy through KfW. In addition, costs incurred for energy consulting are also subsidized.

What options can companies use if the investment costs are too high?

Anyone who cannot or does not want to invest, but still wants to use modern efficiency technologies to heat production halls and warehouses and thus reduce the additional costs caused by theCO2 tax, is well advised to use HeizWerk. This rental model is doubly interesting from an economic point of view – firstly, because companies incur neither investment nor depreciation expenses. Second, because the energy cost savings from efficiency technologies in energy retrofits of existing facilities are usually significantly higher than the rental amount. With the positive result that the companies even have extra money in their coffers after the modernization.

Conclusion: Start reducing your company’sCO2 emissions!

Even if theCO2 tax makes prices rise only slowly, you should not wait too long. Get an overview of your savings potential and reduceCO2 emissions and energy consumption in a targeted manner. Particularly in hall buildings, heating modernization promises great savings potential. Feel free to do the math with our freeCO2 calculator and get an initial estimate of where and how you can still reduce!

These articles might also interest you

Let's take the next step together

Every hall is different. With more than 30 years of company history, there is hardly a requirement that is unknown to us. Together with our customers, we have implemented the appropriate solutions. If you are ready to implement economically proven heating concepts for your hall, then you have come to the right place.