The CO₂ tax: What does it mean for your company?

CO2 also has a price in Germany

At the 2015 UN Climate Change Conference in Paris, the global community decided to limit global warming to well below 2 °C, and if possible to 1.5 °C, in order to protect our livelihoods. To achieve this, we must be greenhouse gas neutral from 2050. Since then, more and more measures have been developed to achieve this goal - both internationally and at European and national level. The European Union wants to reduce greenhouse gas emissions by at least 55% by 2030 (the reference year is 1990). With the so-called EU ETS (European Union Emissions Trading System), there is emissions trading for almost the entire energy industry. The aim is to reduce climate-damaging gases by issuing a limited number of emission allowances as an incentive and trading them freely on the market. However, there has been no such incentive outside of European emissions trading to date. In the 2030 national climate protection program, the German government therefore adopted price incentives in addition to funding programs and regulatory measures.

The transport and heating sectors are particularly important, as they account for around one-third of climate-damaging emissions. CO₂ emissions in the heating sector alone should be reduced by 80% by 2050. The way to achieve this was paved with the entry into force of the Fuel Emissions Trading Act (BEHG) at the end of 2019. Based on this, greenhouse gas emissions now also have a price in Germany. Since 2021, Germany has been using its own additional instrument to reduce CO₂ emissions, known as the CO₂ tax, with the national emissions trading system (nEHS). The federal government has set clear targets:

- Achieving the minimum targets of the EU Climate Protection Regulation

- Meet national climate protection targets, in particular greenhouse gas neutrality in Germany by 2045

- Improve energy efficiency

How does the CO₂ tax work?

The CO₂ tax applies to the transport and building heating sectors. It stipulates that the combustion of fossil fuels such as heating oil, liquefied petroleum gas, natural gas, coal, gasoline, and diesel will be „taxed“ at a fixed, gradually increasing price. This is intended to create incentives to consume less energy and switch to more environmentally friendly alternatives.

But how does the CO₂ tax work? Companies that put these fuels into circulation must purchase certificates known as „emission allowances.“ These certificates are based on a predetermined limit on emissions, and their number is reduced from year to year. Who acquires these certificates varies depending on the fuel. In the case of natural gas, for example, it is the municipal utilities that supply the end consumers. Certificates for petroleum products must mainly be purchased by producers (e.g., refineries) and traders. The costs for these emission rights are passed on to end consumers, i.e., private customers and companies, with the result that prices for heating and fuel will rise from 2021 onwards.

What additional costs will you incur as a result of the CO₂ tax?

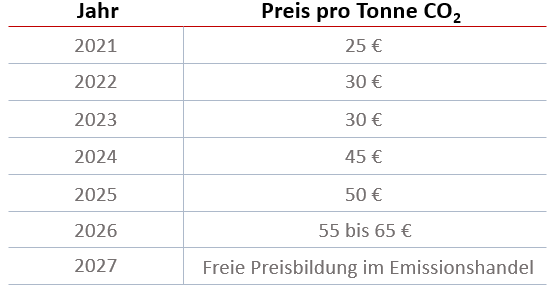

To allow businesses and consumers to gradually adjust to the new system, fixed prices will initially apply to the CO₂ tax. These started at €25 per ton of CO₂ in 2021 and will rise gradually until 2025. From 2026, the regulation stipulated that the cost of the CO₂ tax would initially develop in a price corridor between €55 (minimum) and €65 (maximum) per ton of CO₂, depending on the market, and then transition to a free trading phase from 2027. In 2025, a decision on further pricing will be made at the political level. The cost of fossil fuels will therefore increase gradually. Due to the energy crisis caused by Russia's attack on Ukraine, the annual increase was suspended in 2023. However, as a result of the budget crisis, the federal government is adding a hefty increase from 2024: according to the government's lawsuit of December 13, the CO₂ tax is to rise to 45 euros.

Source: Government declaration of December 13, 2023

What does the CO₂ tax mean in concrete terms, and what should you do?

First and foremost, the CO₂ tax means two things:

- Heating and mobility are becoming more expensive.

- Energy sources, energy use and technologies must be reassessed and made significantly more efficient in order to offset rising costs.

In line with the motto "The cleanest and cheapest energy is energy that is not consumed in the first place", the Federal Ministry for Economic Affairs and Energy is using its campaign Germany does it efficiently on the conservation of resources. The principle of "efficiency before substitution" applies here. For example, if you are already using modern, decentralized efficiency technologies for heating, which work with fossil fuels but are very energy-efficient, there is less need for action. Incidentally, according to GEG24, extensive exemptions and flexible deadlines apply to heating with decentralized technologies in hall buildings above a height of four meters.

Energy efficiency is not only a necessity from an ecological point of view, but is also increasingly important from an economic point of view. This is why you should not hesitate to modernize your heating system or switch to alternative energy sources in the long term. This could also be natural gas in the future - because: The upcoming supply of hydrogen (power-to-gas) and the possibility of producing natural gas synthetically will make this energy source increasingly greener and more renewable. The best way to find out more is to read our further article on Future technologies for heating modernization!

What options does the economy have to save costs despite the CO₂ tax?

The good thing about the BEHG and the new CO₂ tax is that politicians are creating real incentives to make greater energy efficiency, the use of climate-friendly energy sources, and the development of innovative products attractive to companies and consumers. In addition, the fixed price regulation until 2026 provides planning security and a sufficiently large time window to react. As a company or consumer, you can decide for yourself: does it make more sense for you to pay the CO₂ tax or to counteract the cost increase with appropriate measures? Our tip: try to achieve your goals with as little energy as possible and consider using renewable energies in the long term. This way, both sides benefit: the climate and your company. Below are some examples of how you can increase energy efficiency:

- Increased thermal insulation

- The use of energy-efficient technologies

- The use of heat recovery and residual heat

- The use of intelligent control technology

- Switching to energy sources with lower emission values (e.g. natural gas instead of heating oil)

- The integration of solar thermal energy and other renewable energies

How can rising costs be avoided?

- § Section 11 of the SESTA provides companies with financial compensation under a hardship scheme if they are unreasonably affected by rising prices. The prerequisites are

- Fuel costs account for more than 20 % of total operating costs.

- Additional costs incurred by the company as a result of the introduction of SESTA would exceed 20 % of gross value added.

In addition, double charges resulting from the use of fuels in an installation subject to EU emissions trading should be avoided as far as possible.

There are also plans to provide relief to companies that would be disadvantaged on the international market as a result of CO₂ taxation. This is because many foreign competitors are not subject to CO₂ pricing or the resulting increases in fuel costs. The solution comes in the form of the so-called „Carbon Leakage Regulation“: Those who suffer disadvantages on the international market as a result of the CO₂ tax will receive financial compensation. In this way, Germany wants to prevent companies from moving away. However, affected companies must prove that they have an energy management system in place and are already working to reduce their CO₂ emissions. They must then use the benefits to further reduce their CO₂ emissions.

Will my climate protection measures be funded?

At a national level, the federal government has supported investment in climate protection through a series of comprehensive, partially updated funding programs and grants. These include, for example, the Federal subsidy for efficient buildings (BEG) or the Federal funding for energy efficiency in the economy. You could apply for these programs either as a grant via BAFA or as a loan subsidy via KfW. In addition, costs incurred for energy consulting are also subsidized. We will provide information on the current status of the funding programs as soon as they have been finalized.

What options can companies use if the investment costs are too high?

HeizWerk is a good choice for those who cannot or do not want to invest, but still want to use modern efficiency technologies to heat production halls and warehouses and thus reduce the additional costs incurred by the CO₂ tax. This rental model is doubly attractive from an economic perspective – firstly, because it does not involve any investment or depreciation costs for the companies. Secondly, because when existing systems are retrofitted to improve energy efficiency, the energy cost savings achieved through the efficiency technologies are usually significantly higher than the rental amount. The positive result is that companies even have extra money in their coffers after the modernization.

Conclusion: Start reducing your company's CO₂ emissions!

Even though the CO₂ tax will only cause prices to rise slowly, you should not wait too long. Get an overview of your potential savings and take targeted measures to reduce CO₂ emissions and energy consumption. Heating system modernization offers great savings potential, especially in industrial buildings. Feel free to use our free CO₂ calculator and get an initial assessment of where and how you can still reduce!

-

Germany has a huge number of buildings whose heating systems waste energy every day and produce far too much CO₂. With regard to the use of renewable energies and modern technologies, it is by no means just an old stock that urgently needs to be refurbished. Many newly built halls are also equipped with outdated [...]

-

Mr. Kübler, your company produces heating systems for halls. These only make up a small proportion of all buildings in Germany. Why is it nevertheless important to save as much energy as possible in this area? That's right, halls only make up around 1.5 percent of all buildings in Germany, so most people don't notice them. Even [...]

-

Christmas is once again approaching surprisingly quickly - and, unfortunately, one or two challenges are on the horizon. From 3G and 2G plus to the next increases in energy prices. Congratulations if you have already converted your hall heating to an economical system from KÜBLER. This is a really good decision in many respects.

-

What is a dark radiator (really)? In everyday life, the term "dark radiator" is often used interchangeably with infrared radiant heaters. It is also often used to refer to electric infrared heaters. People even talk about electric dark radiators. From a technical point of view, however, this is not really correct. Dark radiators in the true sense of the word are gas-powered infrared heating systems that bring heat into halls in a particularly efficient way. To do this, […]