EU ETS & CO₂ pricing - how can companies get a grip on rising CO₂ costs?

The most important facts in brief:

- The European Emissions Trading System EU-ETS 1 has been in force since 2005, which regulates the emissions of energy-intensive companies and the energy industry through certificate trading in accordance with the cap and trade principle

- To implement this into national law, CO₂ pricing (also known as CO₂ tax) for fossil fuels was introduced in Germany in 2021 and regulated by the Fuel Emissions Trading Act (BEHG).

- From 2027, EU ETS 2 will supplement EU ETS 1 for the buildings and transport sectors and the German CO2-Replace pricing

- Around 75 % of energy demand in industry is required for heat

- Through intelligent efficiency and substitution measures, such as the use of modern, energy-flexible hall heating systems, companies can significantly reduce their CO₂ consumption and cut costs considerably.

How does the ETS work?

The European Emissions Trading System (EU ETS) has been the central climate protection instrument of the EU and three other nations, Norway, Iceland, and Liechtenstein (27+3), since 2005. Since 2020, it has also been linked to Switzerland's emissions trading system. The aim is to reduce CO₂ emissions and other greenhouse gases in the energy sector and energy-intensive industries, while at the same time encouraging the use of climate-friendly technologies. This is done according to the cap and trade principle, whereby an annually decreasing upper limit on emissions is defined (cap) and issued to companies in the form of tradable emission allowances (EUA – European Union Allowances) (trade). The EU ETS is implemented in national law within the framework of NAPs, i.e., national allocation plans (allocation plans).

- Cap (upper limit): Since 2013, the European Union has set an annual cap on the total greenhouse gas emissions that companies subject to emissions trading are allowed to emit. This cap is below the actual amount of emissions and will be gradually reduced over the years. The current plan is to reduce the permitted emission volume by 2.2 percent annually. The linear reduction in the number of allowances will be significantly tightened in the coming years to values between -4.3 and -5.43 %.

- emission allowances (EUA - European Union Allowances): This cap is allocated by the European Union in the form of tradable emission allowances (also known as pollution rights or emission certificates) to companies subject to emissions trading, which must then redeem them for every ton of CO₂ they produce. In other words, for every ton of CO₂ a company emits, it needs one certificate. Most of these CO₂ certificates are allocated by auction, with a smaller portion made available free of charge by the EU. The number of certificates required per company is currently determined by a process known as „grandfathering.“ This calculates the amount of energy that the company has consumed to date or that is absolutely necessary for that company. The company must then purchase additional certificates on its own for the portion that could potentially be saved through modernization.

- TradeTraded (EU ETS or BEHG) are unredeemed certificates from companies and a general free quota. This means that companies whose emissions are below the allocated quantity can sell their surplus allowances on the secondary market. Buyers are the companies that produce more emissions than the allowances allocated to them. As the quantity of allocated emission allowances (EUAs) is reduced each year in European emissions trading, the incentive to make savings increases. For example, the number of allowances auctioned in 2024 fell to 85 million compared to 92 million in 2023.

The EU ETS therefore operates according to market principles, i.e., the price of CO₂ allowances is determined by supply and demand. In economic terms, the emission allowances represent a new scarce commodity was launched on the market, which Production factor can be used in the manufacture of products or resold on the market. The lower the upper limit (cap), the more limited and expensive the certificates become. This creates a financial incentive to reduce emissions. In addition, the market prices for certain products can become more expensive, which can also lead to even more economical use of climate-damaging products.

nEHS in Germany – the CO₂ price

CO₂ pricing is generally an environmental policy measure that puts a price on carbon dioxide (CO₂) emissions by imposing a tax on fossil fuels such as gasoline, diesel, heating oil, natural gas, or coal. The aim here is also to reduce greenhouse gas emissions by creating financial incentives to switch to more climate-friendly alternatives such as renewable energies or energy-efficient technologies. CO₂ pricing has been introduced in 20 countries across Europe to date. Finland and Poland were pioneers in this field, introducing this climate protection instrument as early as 1990.

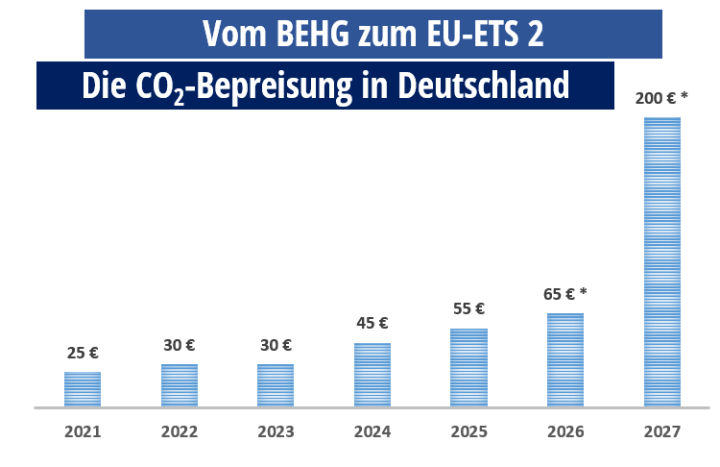

On January 1, 2021, Germany introduced CO₂ pricing, creating a national emissions trading system (nEHS) for sectors not covered by EU emissions trading (i.e., transport, construction, and agriculture), thereby transposing the NAP into national law. This is regulated by the Fuel Emissions Trading Act (BEHG). Since 2024, it has also covered CO₂ emissions from waste incineration plants. This means that a CO₂ price also applies to road transport and heating. Since its introduction in 2021, CO₂ prices in Germany have been rising annually. They were initially defined as fixed prices (2021 to 2025), but will then be replaced by trading of certificates within a price corridor from 2026 onwards. This will be between €55 and €65 per certificate. From 2027, however, this system is to be completely replaced by the new EU ETS 2.

*Note: For 2026, the transition to certificate trading in the price corridor of EUR 55 to 65 per tonne of CO2 From 2027, EU ETS 2 will replace the previous pricing system by introducing free certificate trading on the market with prices that, according to expert opinion, could range between €70 and €340 per certificate. This chart assumes €200 per certificate and ton of CO₂. (Source: KÜBLER GmbH Energy-saving hall heating systems)

Who is affected by the EU ETS and CO₂ pricing?

Companies are either subject to emissions trading – EU ETS or CO₂ pricing (BEHG) – or can join voluntary emissions trading. The EU ETS applies to all 27 member states of the European Union. Norway, Iceland, and Liechtenstein have also joined (27+3). The United Kingdom and Northern Ireland participated in the EU ETS until December 31, 2020 (Brexit). In the first phase, known as EU ETS 1, emissions from around 9,000 facilities in the energy sector and energy-intensive industries with a thermal output of more than 20 megawatts are recorded. Together, these installations account for around 40% of greenhouse gas emissions in Europe. According to Annex 1 of the EU Emissions Trading System (EU ETS), these include in particular:

- Power plants

- Mineral oil refineries

- Iron and steel smelting

- Cement and lime production

- Glass, ceramics and brick industry

- Paper and cellulose production

- Intra-European air traffic (since 2012)

- Maritime transport (since 2024)

While the number of installations is distributed almost one-to-one between the industrial and energy sectors, energy installations are responsible for around three quarters of emissions. Around half of the energy plants are large combustion plants, i.e. power plants, combined heat and power plants and heating plants with a rated thermal input of over 50 MW. These plants are responsible for over 98 percent of emissions in the energy sector. The "big four" energy suppliers, namely RWE, Vattenfall, E.ON and EnBW, are the main operators of large combustion plants in Germany.

As far as Germany and CO₂ pricing are concerned, the obligation to surrender emission allowances generally lies with the so-called "marketers," i.e., the companies that sell diesel, gasoline, and other fuels in Germany for the first time (upstream approach). This nEHS mainly affects mineral oil traders, liquefied gas traders, natural gas and heat suppliers, coal suppliers and coal users, as well as importers and refineries.

In order to avoid double taxation, the interaction between the CO₂ tax and the EU ETS in Germany is designed in such a way that the costs of the CO₂ tax do not have to be passed on to EU ETS operators.

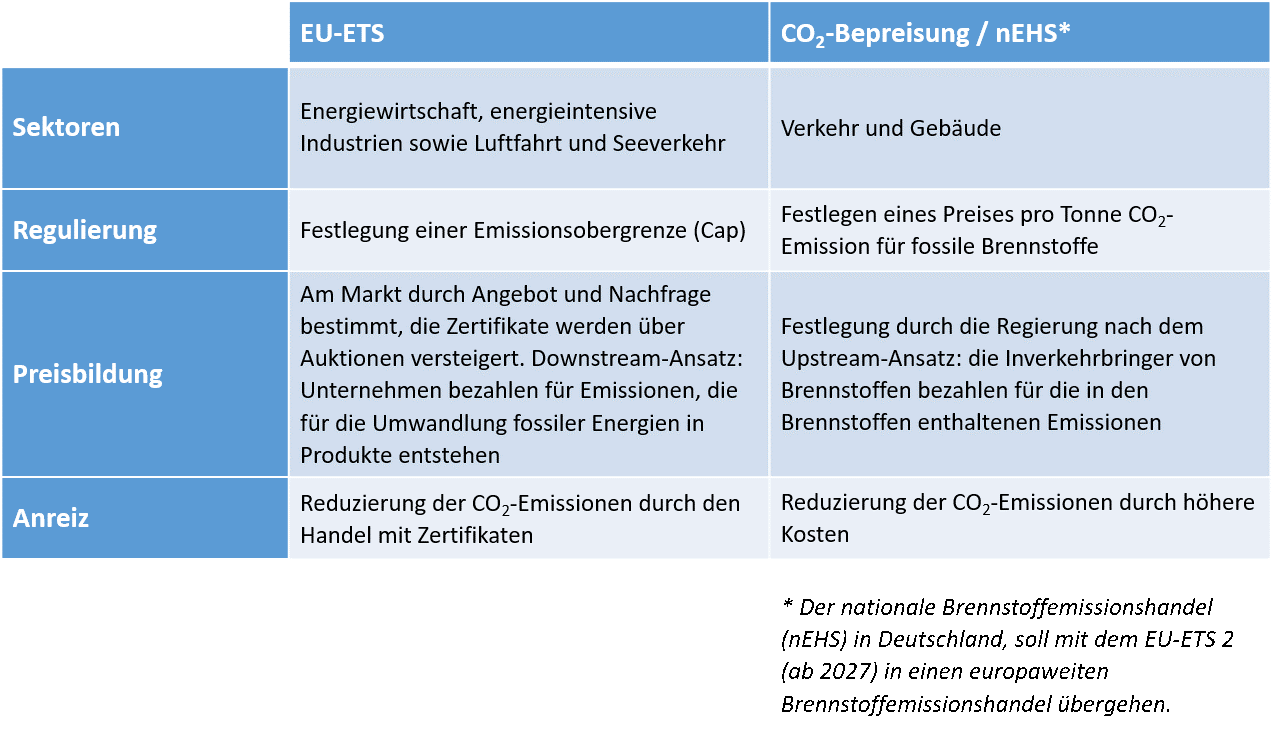

What do the EU ETS and CO₂ pricing have in common? Where are the differences?

CO₂ tax and EU ETS are different mechanisms for CO₂ regulation. Both systems aim to reduce CO₂ emissions. The overlaps between CO₂ pricing and the EU Emissions Trading System (EU ETS) therefore lie mainly in their common objective: combating climate change. Both mechanisms price CO₂ emissions, thereby creating incentives for emission reductions. However, there are also differences, particularly in the way the CO₂ price is set and which sectors are covered. Under the EU ETS, the price of CO₂ is determined by the market, while the price of the CO₂ tax is set by the government.

EU ETS 2 – the new trading system with drastic effects on CO2-Costs?

From 2027, a further independent emissions trading system will be introduced as part of the Fit for 55 package with EU ETS 2. It will apply to emissions from road transport, buildings, and industrial and energy facilities that are not covered by EU ETS 1 due to their size. Pricing will be similar to that already in place. national emissions trading scheme (nEHS) introduced in 2021 via the upstream approach. The allowances will be auctioned in full, with CO₂ prices being determined on the carbon market. Germany has so far set a cap of between €55 and €65, while €45 is being discussed at EU level, with critics pointing to the lack of steering effect here. Other forecasts suggest that prices are likely to be much higher. Experts are predicting a price range of €70 to €340 per certificate at the start of EU ETS 2.

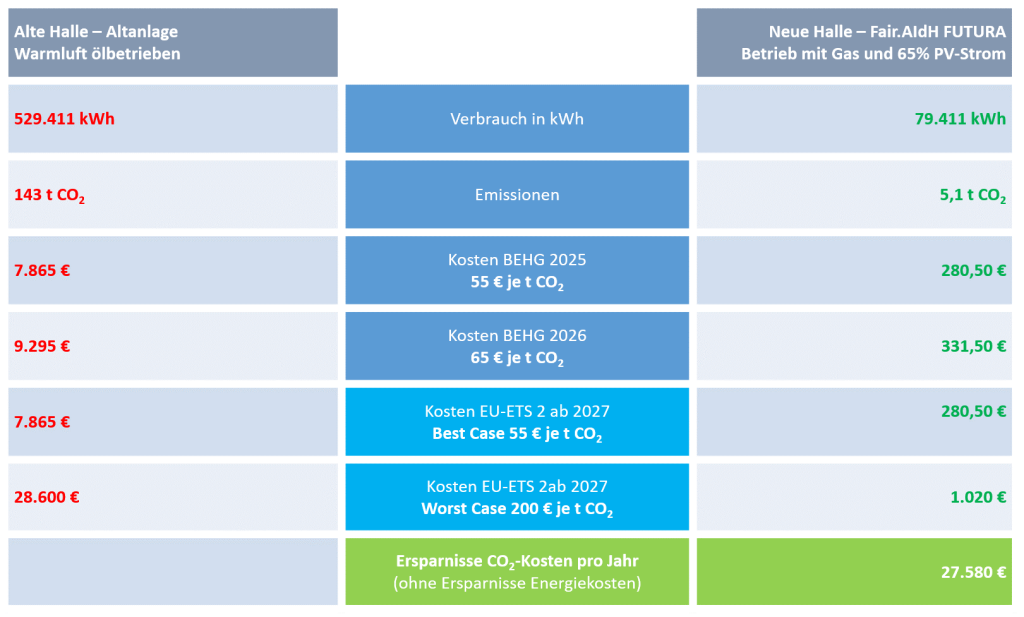

CO₂ costs & economic efficiency from 2027 onwards – a practical example*

* Kanter & Schlosser Metallgesellschaft mbH, Trier (Graphic: KÜBLER GmbH Energiesparende Hallenheizungen)

The EU Commission is currently discussing plans to introduce the "Clean Industrial Deal". The comprehensive package of measures aims to make the European economy more competitive and climate-friendly at the same time. The package for clean industry focuses on four key areas:

- Helping energy-intensive sectors in particular with the transition

- More green technologies from the EU

- Reducing bureaucratic hurdles

- Funding of up to 100 billion euros

Conclusion: Overall, we can only speculate about the level of future CO₂ prices at present, and what this will mean in concrete terms for commercial and industrial companies is still completely uncertain. One thing is clear: from 2027 onwards, CO₂ pricing will become even more international and dynamic. Further adjustments could follow from 2030 onwards, tightening the regulatory framework. And: due to the ambitious climate targets in Germany and the EU, companies will have to expect higher CO₂ reduction requirements in the long term.

What options do companies have for reducing CO₂ costs?

The good thing about the CO₂ tax is that it provides real incentives for companies and consumers to become more energy efficient, use climate-friendly energy sources, and develop innovative products. As a company or consumer, you can decide for yourself whether it makes more sense to pay the CO₂ tax or to counteract the cost increase by taking appropriate measures. Our tip: try to achieve your goals with as little energy as possible and consider using renewable energies in the long term. This way, both sides benefit: the climate and your company. Below, we provide examples of how you can use CO₂ taxes as a control instrument for sustainability and efficiency with a smart strategy.

Invest and benefit from energy efficiency

Accounting for around 75 % of energy consumption in many industries, heat offers the greatest leverage for reducing energy and costs. Energy-efficient hall heating systems such as the Fair.AIdH technologies (e.g. FUTURA, ELEXTRA) in combination with smart control systems (e.g. CELESTRA) has been proven to reduce energy consumption by up to 70 % and more. Given the high levels of consumption in industry, this also significantly reduces the burden on companies and the environment. The changeover is often easier than expected and can usually be implemented during operation.

Switch to renewable energies

High-quality hall heating systems have a service life of 20, 30 years and more. Rely on energy-flexible technologies now so that you can switch to renewable energies such as PV electricity or hydrogen at any time when you invest in a new heating system. The good thing is: with these systems, you can already use the most cost-effective energy sources today and also use them in the mix. This ensures that you can easily meet the requirements for climate neutrality by 2045 (Germany) or 2050 (EU) without jeopardizing the profitability of your company. At the same time, you open up the path to energy self-sufficiency.

Renting instead of investing - why it pays off

Every day that outdated hall heating systems continue to operate represents an excessive cost and environmental burden. Many decision-makers are aware of this and the renovation backlog is well known, yet there are numerous business reasons for repeatedly postponing heating modernizations. However, a solution to this dilemma is less well known: a smart rental model called Heating plant. This rental model is economically interesting for companies in two respects:

- No investment

- No amortization expense

- Up to 20 % total cost reduction depending on the system

The reason lies in the efficiency of the modern technologies used. The amount saved in energy costs usually exceeds the rental fee and results in lower heating costs overall. Anyone who cannot or does not want to invest, but still wants to benefit from modern efficiency technologies for heating production halls and warehouses and thus reduce the additional costs associated with CO₂ pricing, is well advised to choose HeizWerk.

Conclusion: Start reducing your company's CO₂ emissions now!

Even though much remains uncertain at present due to the change of government in the US and Germany and some EU decisions are still pending, companies should develop strategies in good time to ensure they are well positioned for the future. Get an overview of your potential savings and reduce CO₂ emissions and energy consumption in a targeted manner. In industrial buildings in particular, heating modernization with energy-flexible systems (Fair.AIdH*technologies) offer significant savings potential. This not only compensates for high energy prices, but also increases the profitability and future security of your business. Feel free to calculate with the free CO₂ calculator and get an initial assessment of where and how you can still reduce!

Sources:

- CO₂ tax in Europe: 19 EU countries have introduced a CO₂ levy | INDUSTRIEMAGAZIN

- European emissions trading | Federal Environment Agency

- National allocation plan - Wikipedia

- Revenue from emissions trading again at record level | Federal Environment Agency

- https://de.wikipedia.org/wiki/European_Green_Deal#:~:text=Mit%20der%20Zustimmung%20durch%20den,29.%20Juli%202021%20in%20Kraft

- https://correctiv.org/faktencheck/2025/02/21/emissionshandel-was-ueber-die-zukuenftige-entwicklung-der-CO₂ prices announced/

- https://carboneer.earth/de/2024/09/das-neue-eu-ets-2-bepreisung-von-emissionen-in-gebaeuden-und-im-strassenverkehr/

- https://www.t-online.de/mobilitaet/aktuelles/id_100720166/preise-fuer-benzin-und-diesel-neue-prognose-so-teuer-wird-tanken-ab-2027.html

-

Mr. Kübler, your company produces heating systems for halls. These only make up a small proportion of all buildings in Germany. Why is it nevertheless important to save as much energy as possible in this area? That's right, halls only make up around 1.5 percent of all buildings in Germany, so most people don't notice them. Even [...]

-

Only around half of German companies are aware of their waste heat potential - as dena writes in its publication on waste heat utilization as part of the Energy Efficiency Initiative. This means that an estimated 226 TWh of usable heat goes unused every year. That is 36 % of the energy used by the entire manufacturing industry. This clearly costs companies an enormous amount of money, but at the same time the unused waste heat has a negative impact on the environment. Around 60 million tons of the greenhouse gas CO₂ evaporate unnecessarily into the atmosphere every year. In view of rising energy costs and climate protection targets, companies simply can no longer afford to do this.

-

New gas heating quickly in 2023 - often the cheapest decision that also pays off for the environmentThe BMWK is currently causing a stir with a draft bill. This is because it involves a categorical ban on gas heating systems. According to the plan, from 2024, only heating systems powered by 65 % renewable energies may be used. Formally, this can only be heat pumps, district heating or biomass heating. This raises the question: what about the openness of technology in Germany? And who should pay for it? Decentralized gas-powered heating systems are often the only economically and functionally viable solutions, especially in hall buildings.

-

Whether concert fans, art lovers or party enthusiasts: the room temperature also determines the success of events. How hosts ensure a comfortable climate in event halls and exhibition rooms with hall heaters.